Job Market Pulse Expands to Include UK Hiring and Job Market Intelligence

Since launching our business intelligence product, Job Market Pulse, we’ve continuously expanded and improved our jobs database. Today, we’re thrilled to announce that Job Market Pulse now also includes UK employment data.

Whether you want to hone your recruitment strategy, conduct market research, or forecast labor trends, our UK employment data can help. Keep reading to learn more about our data and the intelligence it powers.

How UK Businesses Can Use This Labor Data

Job Market Pulse lets you view job openings data – both current and historical.

Since we began tracking UK job openings in September 2022, we’ve steadily grown our database to a point where users can now identify and analyze trends in the UK labor market. And while our database currently skews toward larger employers, we’ll continue to expand coverage in the coming months.

If you’re familiar with the Office for National Statistics (ONS) data, you may be wondering: Why can’t I just use that data for my business intelligence needs? To help answer that question, here are three capabilities you get with Job Market Pulse that the ONS doesn’t deliver:

- Custom employment data. Unlike the ONS, we can filter data by specific sources (geography, employer, industry, etc.). Only interested in seeing the vacancy trends of companies in your city? We’ll create a custom jobs report for that.

- Daily updates to employment data. We update our jobs database every 24 hours. That means you can track job openings however you please, whether it’s every day, week, or month.

- Personalized coverage expansion. If you want more jobs from a certain region or from specific employers, we can scrape listings to give you the data you want. That’s the benefit of working with a job market intelligence provider that also offers industry-leading web scraping services.

Keep reading for two takeaways our data highlights for the UK job market and how those insights can contextualize data you might get from other sources like the ONS.

Takeaway 1: Despite Mandatory Gender Pay Gap Reporting, Wage Transparency Remains Fairly Low

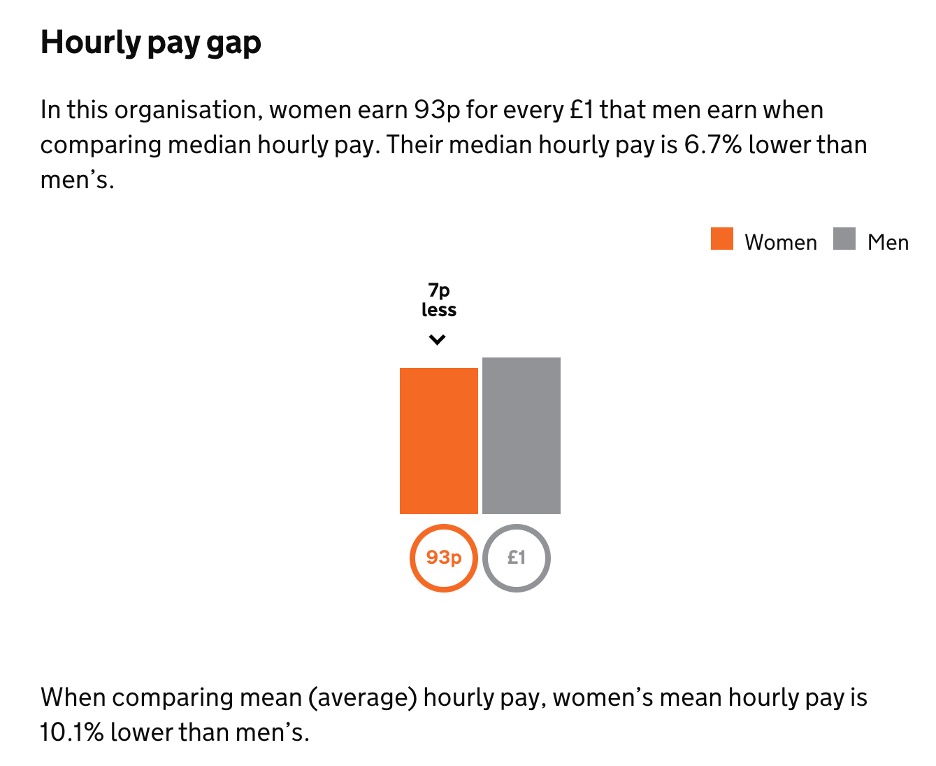

In 2017, the UK introduced mandatory gender pay gap (GPG) reporting to narrow and ultimately eliminate the gender pay gap.

An added benefit of these mandates: greater wage transparency in the UK. Today, job seekers and business leaders can search the GPG site and see pay gaps for 14,000+ employers (Figure 1).

Figure 1: As of April 2022, female Tesco Store employees earn less than their male colleagues. (Source)

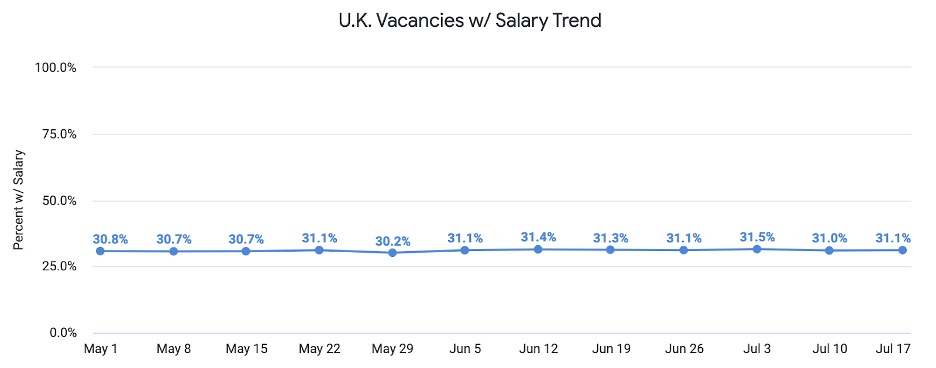

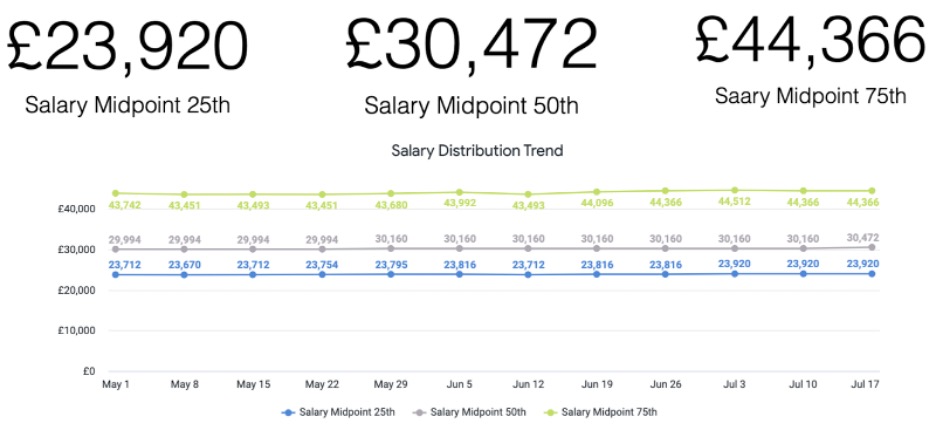

This resource is, of course, useful for recruitment efforts. But it has limitations. You can’t, for instance, see how many employers include wages in job listings or what those wages tend to be. Fortunately, that’s something Job Market Pulse can do (Figures 2 & 3).

Figure 2: Only about 30% of UK job listings include salary data, despite GPG reporting and its emphasis on wage transparency.

Figure 3: As of July 2023, the median salary for jobs in our UK database is £30,742.

With Job Market Pulse, you can see wage information at a national level or from individual employers. This means, if you want to outshine a competitor in the recruiting game, you can view that competitor’s wage insights and ensure you offer a more lucrative package for, say, product engineers.

For more business intelligence use cases, check out: Introducing Our Business Intelligence Product: Job Market Pulse

Takeaway 2: Large Employers Have Reined in Remote Work

Beyond vacancy and compensation data, you can also use Job Market Pulse to see how many employers offer perks like remote work. For example, in the UK, we found that just 2.4 percent of job listings advertised remote work (Figure 4).

Figure 4: Just over two percent of job listings in our UK database advertise remote work.

In our Q2 2023 US Jobs Report, we noted the rapid cutback of remote roles (from a high of 35 percent in May 2020 to just over three percent in June 2023). We can observe a similar effect in the UK. At the peak of remote work, 30.6 percent of employees worked remotely – or “homeworked.”

But our data illustrates a steeper drop than ONS data, which shows that 16 percent of employees work remotely (as of February 2023, the most recent data available).

Why is there a difference? It’s likely because the ONS includes employers of all sizes – even self-employed professionals – while our database mostly features large employers. But this divide could highlight a compelling takeaway: larger employers offer remote work less frequently than smaller employers.

This idea certainly makes sense at face value when you consider the existing office spaces larger employers lease (and want to use). Plus, tech giants like Amazon, Pinterest, and Paypal disclosed as much in 2022 via their mandated public security filings.

One noteworthy quote from Pinterest’s filing:

“…our future work strategy is continuing to evolve and may not meet the needs of our existing and potential future employees and they may prefer work models offered by other companies.”

A recent survey also found that 77 percent of UK-based employees would “actively search for or be open to a new job if their company rolled back flexible work policies.”

What does this all mean? For smaller employers that want to attract and retain top talent, homeworking is a strength you can (and probably should) play up. For enterprise employers, our remote work data can help guide a recruitment strategy that plays to your strengths, like competitive compensation and a vast network.

The Key to Better Job Intelligence Is Custom Data

If places like the ONS publish employment data, why should you partner with a jobs data provider?

While there are plenty of reasons, ranging from convenience (wading through government sites can take hours) to real-time access (government data comes out in monthly drips, if that), the one we want to focus on here is customizability.

You can’t call up the ONS and ask them to pull vacancy data from the 10 largest employers in your city. You can’t ask the ONS to aggregate your competitors’ salary ranges for product managers. You can’t request the ONS share a report of how many job listings advertised remote work in the past six months. You can’t ask the ONS to customize your data.

That’s what we’re here for.

For more information on how a custom job intelligence platform can help you run your business, shoot us a message.